The global shift toward remote work has fundamentally altered how companies approach talent acquisition and team building. As US businesses grapple with talent shortages and rising costs, Latin America (LATAM) has emerged as a strategic solution that combines cost efficiency, cultural compatibility, and exceptional technical expertise. This transformation represents more than just a cost-cutting measure—it’s a strategic reimagining of how modern companies can build their technical workforce in an increasingly connected world.

The Remote Work Revolution and LATAM’s Rise

Remote work has evolved from a pandemic necessity to a permanent fixture in the modern workplace. According to recent data, 69% of US companies now offer work location flexibility, representing a significant increase from 51% in 2024. This shift has democratized access to global talent pools, with 29% of all paid US workdays now performed from home.

The rise of remote work has particularly benefited Latin America, where the remote work talent pool has grown by 35% from 2020 to 2023. Countries like Mexico, Brazil, and Colombia are leading this charge, with over 40% of professionals in the tech sector now working remotely in markets like Argentina and Chile.

This growth isn’t coincidental—it’s driven by strategic investments in education, infrastructure, and technology. Latin America now produces over 450,000 new engineering graduates annually, with Brazil and Mexico alone contributing a combined 605,000 software engineers each year

Why LATAM Has Become the Premier Nearshore Destination

Geographic and Temporal Advantages

Unlike traditional offshore outsourcing destinations in Asia, Latin America offers time zone alignment that enables real-time collaboration. Most LATAM countries share time zones with the US or operate within just 1-3 hours of difference, allowing for seamless communication and instant feedback loops

The time zone advantage translates into tangible business benefits. 72% of US companies hiring remote talent in LATAM cite time zone compatibility as a major factor in their decision. This alignment means no more overnight delays, missed communications, or scheduling conflicts that plague offshore arrangements.

Cultural Compatibility and Communication

Cultural alignment between LATAM professionals and US teams creates a foundation for successful collaboration. Many LATAM developers share similar work ethics, communication styles, and business practices with their North American counterparts. This cultural compatibility reduces friction and enhances team cohesion.

English proficiency across the region continues to improve, with Argentina ranking #1 in Latin America for English proficiency according to the EF English Proficiency Index. Countries like Argentina, Uruguay, and Chile demonstrate particularly strong English capabilities, while others like Mexico and Colombia are rapidly advancing their language skills.

The Cost Advantage: Significant Savings Without Quality Compromise

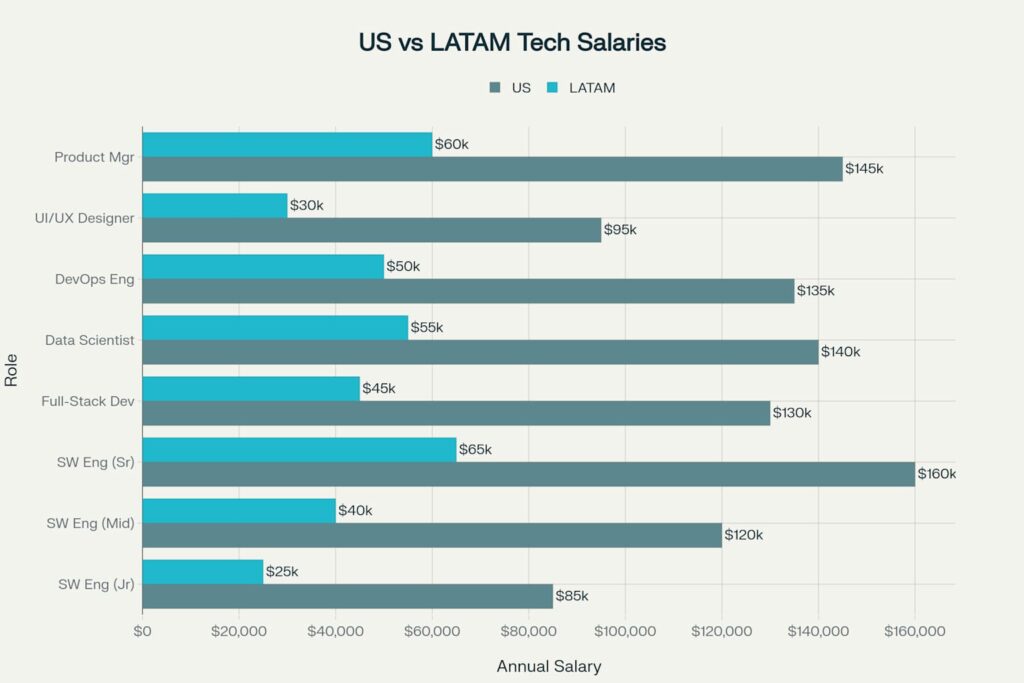

The economic benefits of hiring LATAM talent are substantial and measurable. Companies can achieve 30-50% cost savings compared to hiring equivalent US talent while maintaining high quality standards.

Annual salary comparison between US and LATAM tech talent across various roles, showing significant cost advantages for companies hiring from Latin America

The savings extend beyond base salaries to include:

- Lower operational overhead: Office space and infrastructure costs are significantly reduced

- Favorable exchange rates: Currency advantages amplify savings

- Reduced employment taxes: Many LATAM countries offer competitive tax structures for international hiring

For startups and growing businesses, these cost advantages make scaling more feasible while maintaining competitive quality. The savings can be reinvested in other strategic areas like product development, marketing, or team expansion.

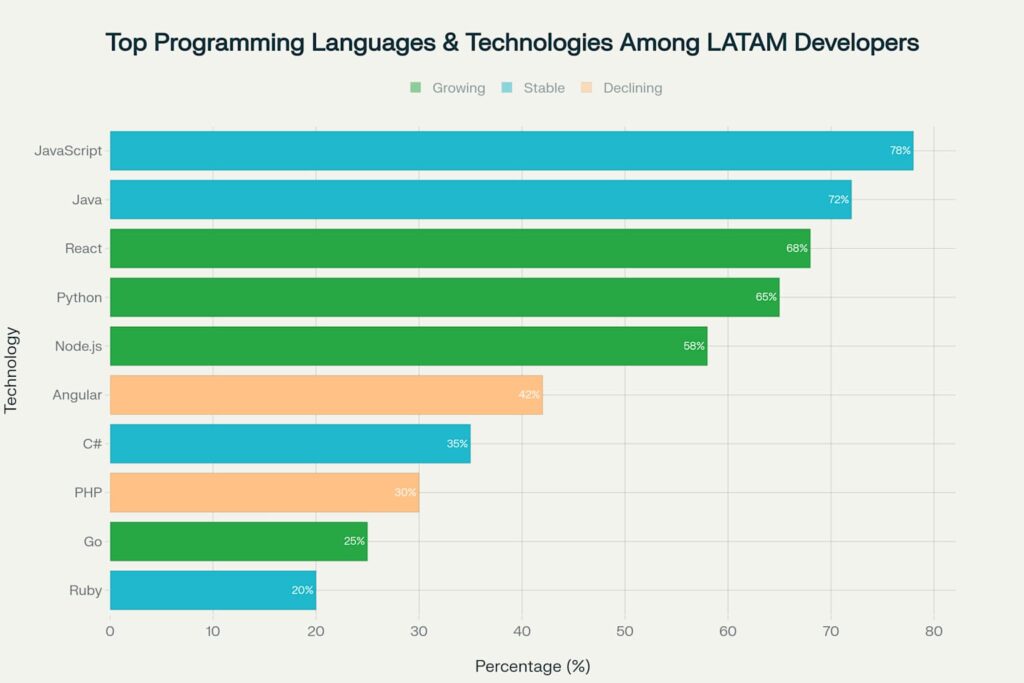

Distribution of programming languages and technologies among LATAM developers, with colors indicating growth trends in the region

Emerging Technology Specializations

The region has developed particular strength in several key areas:

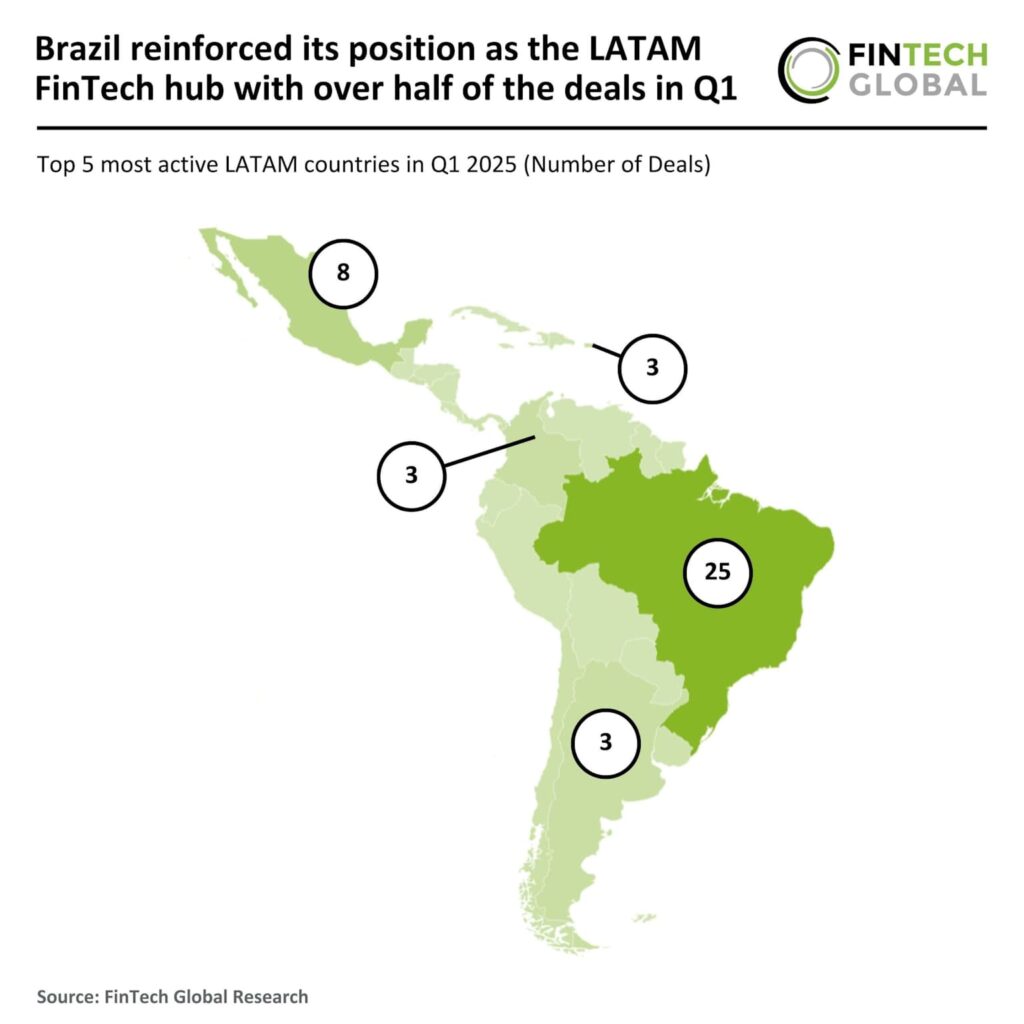

Fintech and Financial Services: Latin America has become a global fintech hub, with Brazil alone accounting for over half of all LATAM fintech deals in recent quarters. This growth has created a deep pool of developers specialized in financial technologies, blockchain, and secure payment systems.

Brazil leads Latin America as a FinTech hub, showcasing the region’s growing technology sector and talent pool

Cloud and DevOps: Growing expertise in cloud-native technologies, with over half of Mexico’s engineers specializing in full-stack development, back-end, front-end, cloud, and mobile engineering.

AI and Machine Learning: 50% of LATAM professionals prioritize AI training, higher than other global regions, positioning the workforce for emerging technology demands.

Infrastructure and Remote Work Readiness

Latin America has made significant investments in technology infrastructure, creating an environment conducive to remote work. Internet penetration rates have soared from 43% to 78% between 2012 and 2022, with countries like Argentina achieving 86.8% internet penetration and 89.6% broadband penetration.

A blue pushpin marks Brazil on a colorful world map, symbolizing the geographical focus of talent sourcing

This infrastructure development includes:

- High-speed internet connectivity: Enabling seamless video conferencing and collaboration

- Modern co-working spaces: Supporting flexible work arrangements

- Government initiatives: Supporting tech education and digital transformation

- 5G rollout: Improving connectivity and enabling advanced remote work capabilities

Success Stories and Market Growth

Major US companies have already recognized and capitalized on LATAM’s potential. Amazon, Google, Microsoft, and other Fortune 500 companies have established significant operations in the region, leveraging the talent pool for various functions from customer support to software development.

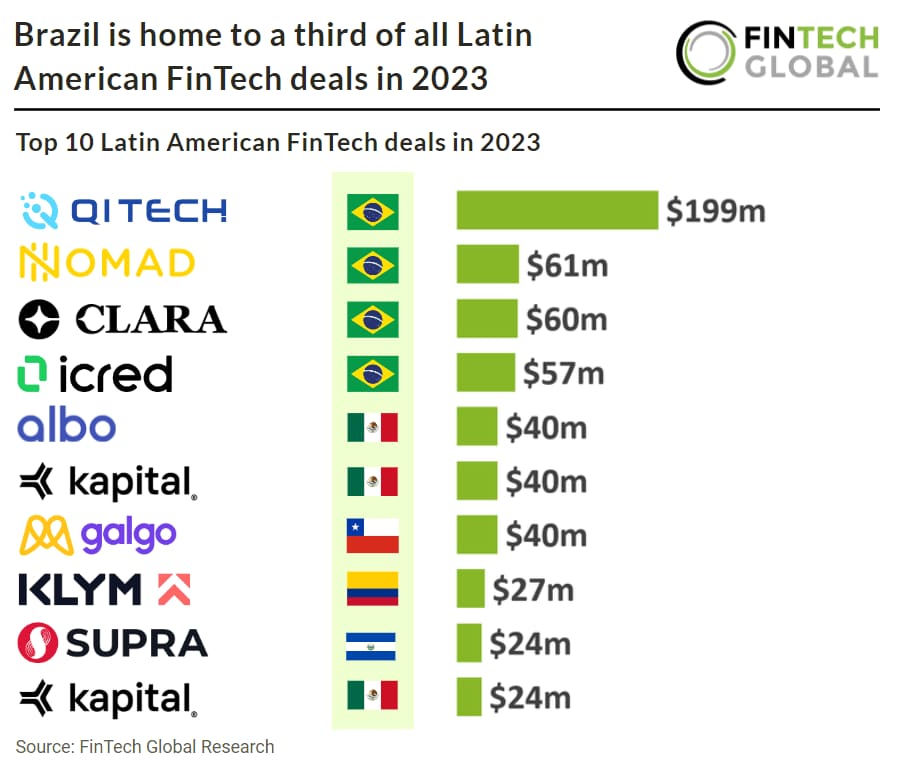

Top 10 Latin American FinTech deals in 2023, illustrating significant investment and growth in the region’s technology sector

The trend is accelerating, with 80% of companies in North America actively considering nearshore options. This shift represents a fundamental change in how US businesses approach global talent acquisition, moving from purely cost-driven decisions to strategic partnerships that enhance capabilities and competitiveness.

Investment and Growth Indicators

The numbers tell a compelling story:

- $2.6 billion in venture capital investments in LATAM fintech during 2024

- Over 2.2 million software engineering professionals in Brazil and Mexico alone

- 10 million new IT job openings projected in LATAM by 2025

- 156% increase in hiring demand for LATAM developers in recent years

Strategic Considerations for US Companies

Building Effective Nearshore Teams

Successful nearshore partnerships require thoughtful planning and execution. Companies should consider:

Team Integration: Establishing clear communication protocols and collaboration tools that work across time zones and cultures.

Legal and Compliance: Understanding labor laws, tax implications, and data protection requirements across different LATAM countries.

Cultural Onboarding: Investing in cultural exchange and team building to create cohesive, productive working relationships.

Technology Infrastructure: Ensuring robust communication and collaboration tools that enable seamless remote work.

Selecting the Right LATAM Markets

Different LATAM countries offer distinct advantages:

Brazil: Largest talent pool with strong fintech and enterprise capabilities

Mexico: Excellent time zone alignment and proximity to US markets

Argentina: Superior English proficiency and technical expertise

Colombia: Rapidly growing talent base with strong cultural compatibility

Chile: Specialized in cybersecurity and regulatory compliance

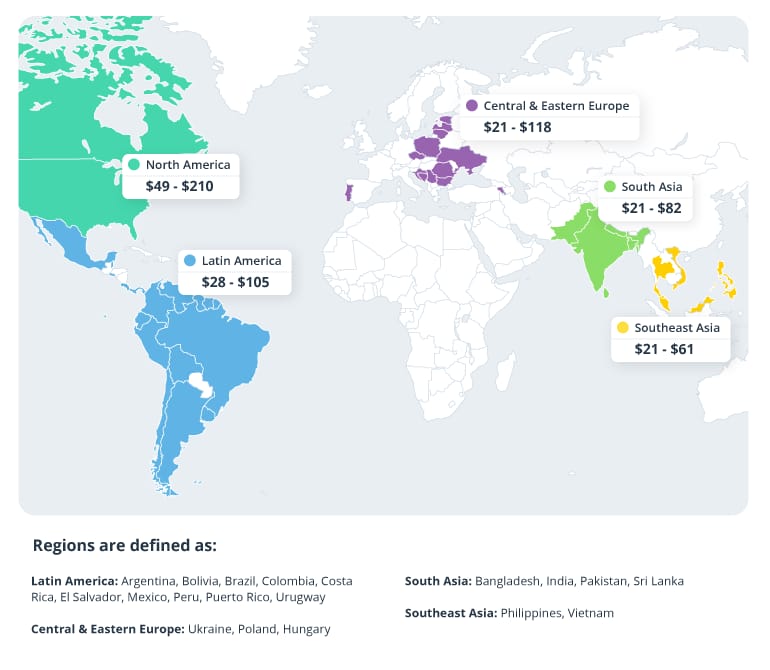

Cost ranges for nearshore and outsourcing talent by region, highlighting Latin America as a competitive option for US companies

Looking Forward: The Future of LATAM Nearshoring

The nearshore outsourcing market is projected to reach $587.3 billion by 2027, with LATAM playing an increasingly significant role. This growth is driven by several converging factors:

Digital Transformation: Accelerating demand for technical skills and digital capabilities

Remote Work Normalization: Permanent acceptance of distributed teams and remote collaboration

Educational Investment: Continued improvement in STEM education and technical training

Infrastructure Development: Ongoing improvements in connectivity and technology infrastructure

Conclusion

The convergence of remote work adoption, LATAM’s growing technical capabilities, and the strategic advantages of nearshore outsourcing creates a compelling opportunity for US businesses. Companies that embrace this trend position themselves for sustainable growth, cost optimization, and access to world-class talent.

The evidence is clear: Latin America has evolved from an emerging market to a strategic partner for US businesses seeking to build competitive, cost-effective, and culturally aligned teams. As remote work continues to reshape the global workforce, LATAM’s combination of technical expertise, cultural compatibility, and economic advantages makes it an indispensable part of the modern business strategy.

A software developer deeply focused on coding at her desk with a tablet and multiple screens

The future belongs to companies that can effectively leverage global talent while maintaining team cohesion and operational excellence. For US businesses, Latin America represents not just a cost-saving opportunity, but a gateway to innovation, scalability, and sustained competitive advantage in an increasingly digital world.

Recent Comments