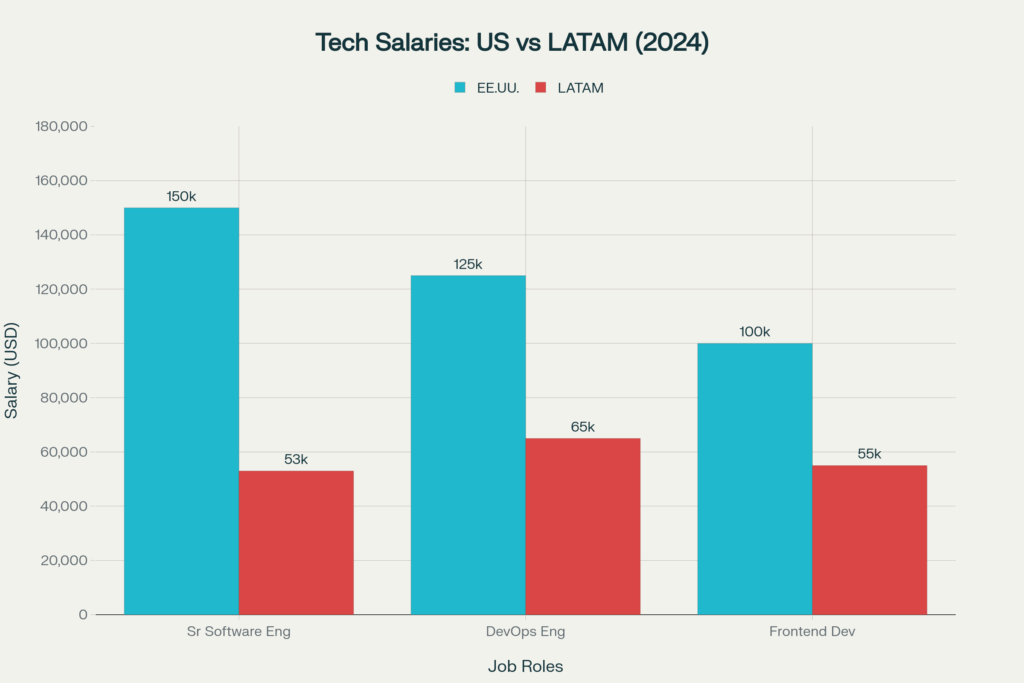

1. Substantial Cost Savings on Technical Roles

U.S.–LATAM salary differences average between 40% and 60% for most technical positions. Companies can hire skilled senior developers in Colombia or Mexico for a fraction of U.S. rates—without compromising quality.

1.2 Real-Time Collaboration

Mexico (CST), Colombia (COT) and most of the Andean/Caribbean corridor sit within one hour of Eastern or Central Time, eliminating the 8- to 13-hour lag companies face with Asia.

1.3 Cultural & Linguistic Compatibility

- 65% of LATAM professionals rate at B2 English or higher; Argentina, Costa Rica and Honduras now score in the “High proficiency” tier.

- Business etiquette—relationship-centric yet deadline-driven—mirrors U.S. norms more closely than many offshore regions.

1.4 Deep, Diverse Talent Pools

The region hosts 2 million+ developers; Brazil and Mexico graduate 600,000 engineers a year—six times the U.S. output on a per-dollar basis. Governments from Chile to Colombia offer STEM tax incentives and free coding bootcamps, fueling continuous supply growth.

1.5 Quantified ROI

- Near-shoring delivers 30 – 50% direct payroll savings plus 60 – 80% lower travel costs versus Asia.

- Project success rates rise to 80% when teams work in overlapping time zones, compared with 60% for traditional offshore models.

2. Quality without Compromise

2.1 Education & Skills

Top universities—TEC de Monterrey (MX), Universidade de São Paulo (BR), UBA (AR)—rank in the global QS top 500 and run bilingual computer-science tracks. LATAM developers excel in JavaScript, Python, mobile, cloud, fintech and AI.

2.2 Retention & Engagement

Well-paid remote engineers in LATAM show < 15% annual churn—far below Silicon Valley’s 20 – 30%. Long tenures cut re-hiring overhead and preserve domain knowledge.

2.3 Regulatory & IP Protections

Most major venues (Mexico, Colombia, Chile) have WTO-TRIPS-aligned IP statutes and allow U.S. companies to hire through Employer-of-Record structures that ensure full compliance and rapid onboarding.

3. Country Snapshots (2025)

(All figures are senior-level averages; U.S. equivalents range $115 k – $170 k.)

4. Implementation Playbook

- Pick the right model

- Direct contractor via Employer-of-Record for ≤ 10 hires.

- Build a near-shore captive center (> 20 FTEs) for strategic functions.

- Benchmark local compensation—pay top-quartile LATAM rates to minimize attrition.

- Onboard in Spanish and English; embed developers in daily stand-ups to leverage time-zone overlap.

- Harmonize processes—mirror U.S. sprint cadence, but respect relational communication styles.

- Invest in upskilling—sponsor AWS or AI certifications; 84% of LATAM employers already co-fund training.

5. Conclusion

Hiring Latin-American talent is no longer just a cost-saving tactic—it is a strategic lever for speed, diversity, and resilience. Companies that integrate near-shore engineers today secure sustained competitive advantage as North-American labor markets tighten and remote work becomes the default operating system of global business.

By aligning wages with regional benchmarks, maintaining U.S.-equivalent quality standards, and exploiting near-time collaboration, firms can unlock 30 – 50% OPEX savings, shorten release cycles by up to 25%, and build culturally compatible teams that stay longer and innovate faster.

The smart money is already in LATAM. The question is not whether to hire there—but how quickly you can start.

Recent Comments